Do you consider only finance to be a part of keeping your markets on the go? Well, if you consider, there is a major setback for you. Apart from the financial surveys, any organization must include room for technical analysis. Technical analysis is essentially the survey of stocks, trends with the help of various charts and statistical tools.

The importance of technical analysis spans various sets of organizations. Be it companies manufacturing shoes, or perishable items, technical analysis plays a very important role. There are various types of analysis that are in use. A company or an organization makes use of types of technical analysis based on its structure and service.

Anyone who comes across the technical analysis term would generally perceive it as a complex concept. However, if we dive into understanding it, we would know that it is easy and very helpful. Technical analysis examples would further aid as in understanding the concept, precisely and clearly. Let us dive into the topic more, and understand it closely.

Takeaway

Technical analysis is essentially the survey of stocks, trends with the help of various charts and statistical tools. It gives an insight in the understanding of how a company should progress ahead in investments.

Read our blog on Project Management: A Complete Understanding On What Is Project Management

What Is Technical Analysis?

In a layman’s language, technical analysis is synonymous with finding all kinds of opportunities in the market world. It is knowing about what could be done next and what is most trending in the market. In more technical terms, technical analysis is the study of prices and trends, with charts being the prominent tools. This concept of analysis was first coined in 1900 by Charles Dew.

His theory for analysis includes various dimensions of studying the market. The theory includes a study on the nature of prices, discount prices, the divergence of prices and changes in prices.

An example of technical analysis is studying the prominence of different products in your company. For instance, your company wants to know the growth of its two different products. Here, your company would set up a analysis with different charts and tools. These would be essential in understanding the current stats for the products. Also, it would enable the predictions of the product growth in the coming days.

The same technical analysis would help you to understand whether the products would excel or not in the future. This again would be done by studying its growth for a set schedule for the analysis.

The above technical analysis example presents to us the cruciality of analysis for the organization. It works as an indicator of how your company would work in the future [1]. Most importantly, analysis tells you whether there would be a potential rise or fall. The charts and statistical tools are used for determining how the market behaves with price changes. This again is based on several underlying assumptions that are a part of analysis.

Takeaway

In general terms, it provides opportunities to grow the company and investment in future. It indicates the change in prices, which are in turn influenced by shift in trends.

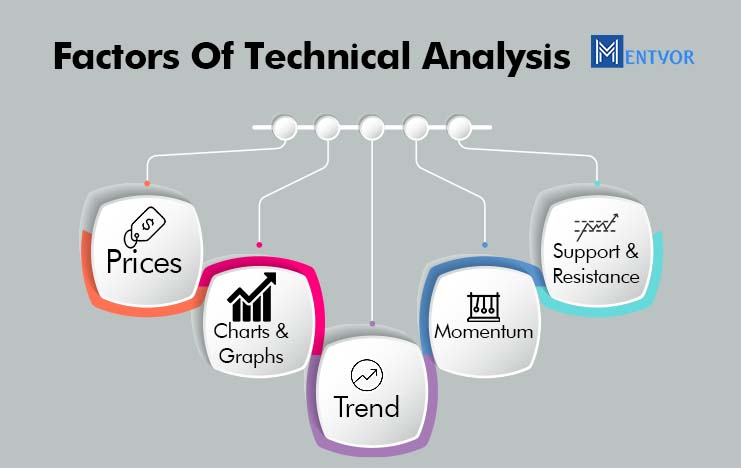

Factors Of Technical Analysis

There are various factors that only pertain to the concept of analysis. These factors are the main determinants while conducting a analysis. The importance of technical analysis revolves around these factors or basics. Let us know these basics of analysis in detail.

Prices

One of the primary fundamentals of technical analysis is price. A technical analyst is keenly involved in studying the charts to know the prices fluctuation. This aids importantly in determining the future movements for the organizations. It helps them in knowing how to decide upon the price for their products. It also evaluates how the trend changes the price of the products. The technical analysis is also involved in knowing the investor’s side, and their interest in one’s company. This helps in deciding the stable price for the future.

Charts And Graphs

The basic study or analysis in technical analysis is through charts and graphs. Here, the company could generate its charts and graphs to know its growth. It helps in the prediction of the next step of growth for the company. Similarly, for a new venture to start, it can start a analysis to know the trend for its services. It also helps in understanding the consumer side of the story. Based on the rise or fall in the graphs, the technical analysts can make out their reach to the customers.

Trend

Everything in a analysis revolves around the trend. The importance of technical analysis revolves around what is the latest in the market world. It is also the most important factor to determine stock investment. If the trend is high, the stock investment would bring in ample profits. The trend in analysis is of three kinds – uptrends, downtrends and horizontal trends. Uptrends are when there are either higher lows or highs predictability for the company. Downtrends are when there are either lower highs or lows for the company. The horizontal trend is when the high or low investment remains unchanged.

Momentum

The importance of technical analysis dwells on the fundamentals of momentum too. Momentum is defined as the speed in changes of prices in the market world. It is also considered to be synonymous with a ‘relative strength index. The changes in prices during a fixed time period is called the momentum. Based on this momentum, there is a clear picture for the company to invest or let it go. Further, the time period for its factor is fixed and the entire analysis happens to know the potential at the earliest.

Support And Resistance

The analysis revolves around the support or resistance of the investment in the market world. The previous lows of an investment that are below the current price are called the support. The previous highs of an investment that are below the current price are called resistance. Here, the support indicates that the demand is high to prevent any dip in the prices. However, the resistance indicates that there would be a dip in shares and no point to move for higher prices.

These are the basics of technical analysis. Knowing these basics is essential to start with our analysis. A complete technical analysis involves the amalgamation of all these basics. Even if one is left out, the entire analysis would rupture or indicate wrong results.

Takeaway

The key factors of analysis are:

- Prices

- Charts and graphs

- Trends

- Momentum

- Support and resistance

Phases of Project Management you should know: A Complete Outline Of 5 Phases Of Project Management Lifecycle

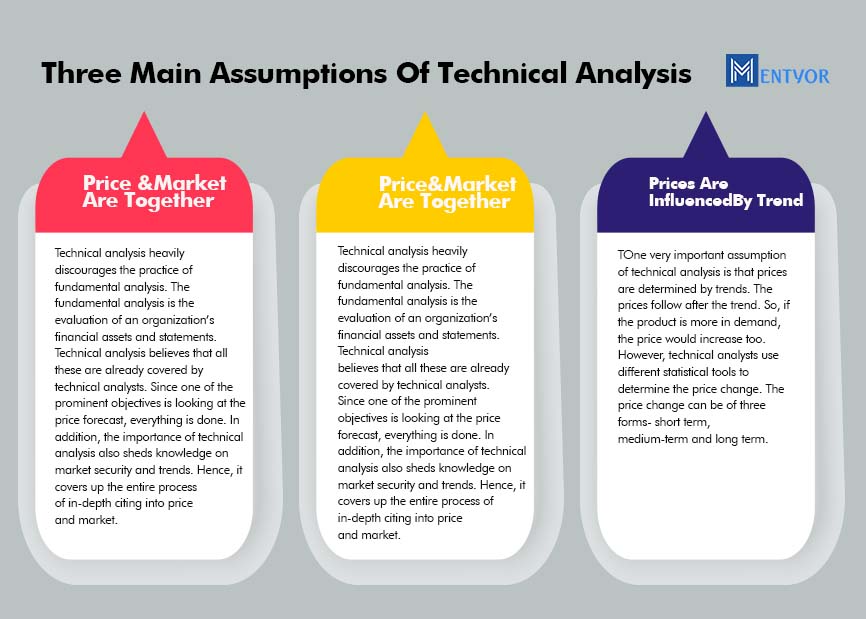

Three Main Assumptions Of Technical Analysis

Every concept applied in the market and business world included underlaid assumptions. These assumptions in technical analysis amplify the understanding of the market. They help in knowing what is the trend, what price has changed and what profits can be conceived. Analysis keeps three assumptions in check while being carried out practically. These three important assumptions are:

History Returns Always

It holds the faith in repeating history, especially for the security prices. The analyst believes that there is a cycle of price, and it continues to return. For instance, the price of a product would rise, fall and then rise again. This assumption is a major part of market psychology. According to this, the consumer needs many shifts in cyclic patterns. This affects the rise and fall of a product or service.

Price And Market Are Together

Technical analysis heavily discourages the practice of fundamental analysis. The fundamental analysis is the evaluation of an organization’s financial assets and statements. Analysis believes that all these are already covered by technical analysts. Since one of the prominent objectives is looking at the price forecast, everything is done. In addition, the importance of technical analysis also sheds knowledge on market security and trends. Hence, it covers up the entire process of in-depth citing into price and market.

Prices Are Influenced By Trend

One very important assumption of technical analysis is that prices are determined by trends. The prices follow after the trend. So, if the product is more in demand, the price would increase too. However, technical analysts use different statistical tools to determine the price change. The price change can be of three forms- short term, medium-term and long term.

These are the three main assumptions for technical analysis. Knowing these three factors gives the path for an organization to curate its technical analysis.

Takeaway

The three main assumptions in analysis are:

- History Returns Always

- Price And Market Are Together

- Prices Are Influenced By Trend

Know about Data Governance: What Is Data Governance | Importance Implementation and 5 Principles

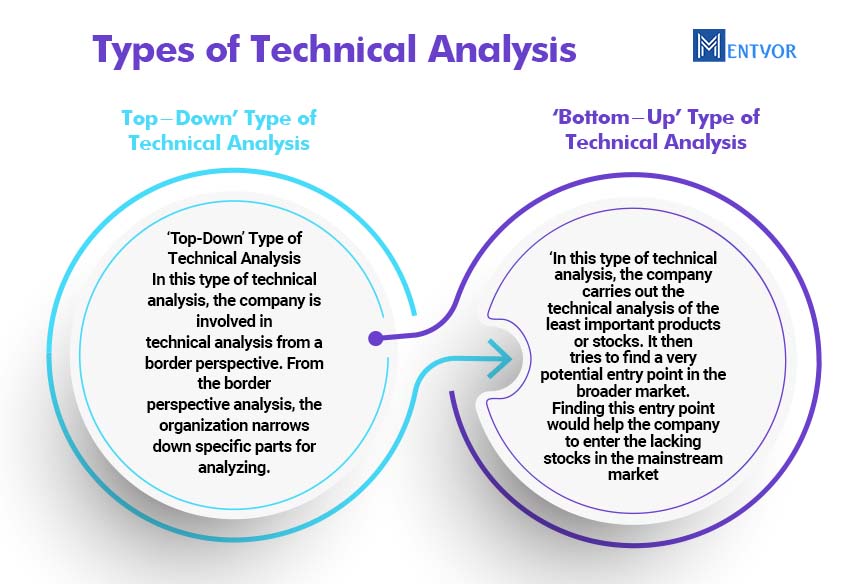

Types of Technical Analysis

In a broad sense, there are two types of technical analysis. These two types of technical analysis are very significant. An organization applies these types of technical terms, based on its analysis part. Below is a close explanation for the types of analysis.

‘Top-Down’ Type of Technical Analysis

In this type of technical analysis, the company is involved in analysis from a border perspective. From the border perspective analysis, the organization narrows down specific parts for analyzing. For instance, a company using this type of analysis would first analyze the charts for all products. After this, it would narrow down to understand which product graph requires more attention. With this type of analysis, it becomes easier to simplify the problems specifically. It also indicates where the potential results could be cultivated with the next investments.

‘Bottom-Up’ Type of Technical Analysis

In this type of technical analysis, the company carries out the analysis of the least important products or stocks. It then tries to find a very potential entry point in the broader market. Finding this entry point would help the company to enter the lacking stocks in the mainstream market. With this, the company would also look into the spaces that can be cleared out and replaced. For this, an immense and rigorous study on the charts has to be done. The elimination and replacement in the analysis should not disturb the overall working in a company.

These are the two types of technical analysis that are commonly used. Both of them provide the scope to make the best of the companies workable and profitable.

Takeaway

There are two main types of technical analysis. These are:

- Top-Down Technical Analysis

- Bottom-Up Technical Analysis

Best Project Management Tools to start your Journey: 11 Best Project Management Tools To Start Project Management Journey

Parting Note

Technical analysis is as essential as running a financial analysis for the company. In analysis, we make use of charts, graphs and other statistical tools. This indicates the change in prices, and what is the current trend in the market.

The technical analysis example involves an understanding of the nature of the rice change. This helps any organization to know the next step in amplifying the reach for the product. Further, it also helps the company to know where it can yield potential results in investing.

There are basics for technical analysis. These are price, charts, graphs, momentum, trend, support and resistance. The process of analysis is carried out with these fundamentals. Knowing these basics of analysis, one can understand the minor parts to take care of. These factors also work as the primary determinants in the overall technical analysis.

There are three main assumptions made in analysis. These are:

- History Returns Always

- Price And Market Are Together

- Prices Are Influenced By Trend

These three assumptions are indicative of price returns, sync between price and market. It also indicates that trends are the heavy influence for shifts in prices. If the trend goes high, it indicates a high price and profit.

There are two common types of technical analysis. These are:

- ‘Top-Down’ Type of Technical Analysis

- ‘Bottom-Up’ Type of Technical Analysis

An organization makes use of these types of technical analysis on the basis of its requirement for it.

Commonly Asked Questions

- What are the methods of analysis?

There are 3 prominent methods for analysis. These 3 methods are:

- DCF method of technical analysis

- Comparable companies

- Precedent transactions

- What are the 4 basics of technical analysis?

There are wide fundamentals while applying analysis. However, there are 4 analysis fundamentals. These are:

- Price is the determinant for the nature and shift in pricing.

- Trend, it is the indicator of what is popular and emphasizes on profitable investment.

- Momentum, it is the determinant of the rise or fall.

- Support and Resistance. It is the determinant for the profitability of investments of stocks.

- What are analysis skills required?

Every technical analyst must have the skills of identifying the trends. The technical analyst must be proficient in reading the graphs and drawing out the apt conclusions. Further, the technical analyst must also be proficient in indicating the next step for the company to excel.

References

[1] Schwager, J. D. (1995). Technical analysis (Vol. 43). John Wiley & Sons.

WhatsApp

WhatsApp