PANDEMIC DID NOT BRING RECESSION 2020

The pandemic in the year 2020 spread like wildfire infecting millions of people and bringing economic activity to a standstill. Many countries all over the globe had imposed strict lockdown. Everyone wants to know if PANDEMIC DID NOT BRING RECESSION 2020 or did it?

Due to imposition of the lockdown economic activities like production declined causing the level of unemployment to rise. The COVID-19 pandemic caused disruptions in the demand and supply chains. The demand side was affected as there was less to no productions due to imposed lockdown.

Staff were laid off since there was no production, it in turn affected the income of many people. Due to no income generation, it greatly affected the demand chains in the market.

Productivity got disrupted from the supply side due to closure of manufacturing units, it also hampered the supply chain. The International Monetary Fund stated that the global economy will be shrinking by more than 3% for the year 2020.

It was reported in the United States of America, that due to pandemic millions filed for unemployment benefits given by the state. The manufacturing units in many countries have dried up leading to widescale fall in internal and external demand.

Due to the rise in significant rise in the number of cases of COVID-19 the global stock markets went down in the month of February. By the end of march, the global stock markets crashed.

Immediate Effects of Pandemic

The pandemic hit the world stage which caused a significant behavioral change like change in preferences, shortage of food, immense price rise and lastly crashing of the stock market. These immediate changes affected the global market both from the demand side and as well as the supply side.

Causes of Recession

Recession is typically the fall in real GDP which is caused due to the fall in aggregate demand in the market. This fall in aggregate demand can take place due to the following reasons.

Shortage of Liquidity – PANDEMIC DID NOT BRING RECESSION 2020

If there is a financial crisis in the economy due to the shortage of liquid assets or money. This shortage of liquidity will reduce the money that the banks or other financial institutions have for lending which will ultimately lead to fall in investments.

Increase in Interest Rates

At the same time when there is shortage of liquidity in the hands of banks it will increase the interest rates. The increase in interest rates will increase the cost of borrowing money from banks. This will cut short the money that is available in the hands of the public causing a fall in demand.

Cut in Employee Wages – PANDEMIC NOT THE CAUSE OF RECESSION 5.0

Since there will be no funds available for business for investment industries will cut wages of their employees. This will lead to fall in the real wages.

Deflation due to price fall

When there is decrease in aggregate demand, the prices of goods and services will fall causing deflation and further lead to backward economy or deeper economic crisis.

Devaluation of Currency – PANDEMIC DID NOT BRING RECESSION 2020

Due to deflation, it will further lead to devaluation of currency of the home country. When there is devaluation of home currency there will be an increase of the exchange rate making the exports expensive and thereby leading to fall in exports.

Suggested Blogs:

- What is Spatial Order In Assignment and How can I use it in my Essay?

- The Economics Assignment Help From Experts At Mentyor Will Save Your Day

- WHAT IS STRATEGIC MARKETING MANAGEMENT

Factors causing Recession

Now it is time to investigate the factors causing recession from the aggregate supply side of the market. One of the primary factors responsible for recession from the supply side is the increasing oil prices in the international and domestic markets.

Increase in Oil prices – PANDEMIC DID NOT BRING RECESSION 2020

When there is an increase in the oil prices the cost of production also increases which will increase the prices of goods and services in the market.

Real GDP decreases

When cost of production increase the real GDP decreases in turn decreasing the size of the economy. This happens as there is lesser production of different goods and services.

Increase in general price – PANDEMIC NOT THE CAUSE OF RECESSION 5.0

At the same time, the increase in cost will also increase the general price level of the goods and services that are produced in the economy. The increase in the general price level is also termed as inflation.

Therefore, ultimately the fall in production will lead to fall in GDP and recession is caused.

Let us see the previous other recessions that took place in the years of 1975, 1982, 1991, 2009 and 2020.

Recession 1.0 in 1975 – PANDEMIC DID NOT BRING RECESSION 2020

Economic stagflation in most of the western countries like United Kingdom, United States, Sweden, France, Finland, Luxembourg, Belgium and Denmark, hit the recession of 1975.

Apart from United States and United Kingdom, the other countries were more hit by the oil crisis. The countries were affected with high unemployment level with high inflation rates called as stagflation.

In America, the recession lasted from 1973 to 1975 and brought about low economic growth. In United Kingdom, recession caused the GDP level to fall causing a contraction of the economy.

Easy money policies, was the principal reason behind the recession. These was designed by the American Central Bank, creation of full employment in the economy was its sole purpose.

The result was increase in the domestic price of goods and services which ultimately led to high inflation and further to crash of stock markets.

Recession 2.0 in 1982 – PANDEMIC NOT THE CAUSE OF RECESSION 5.0

The recession that hit in the year 1981- 1982 was caused due to the deflationary monetary policies of the US government. The Federal Reserve adopted policies of cutting down the domestic spending.

The background of this recession can be traced back in the Iranian Revolution of 1979 that sparked a huge increase in the price of oil. When the prices of oil increased, it pushed up the prices of other commodities in the market causing inflation in major economies.

Now to curb the prices US Government planned to cut down the domestic spending causing a recession.

Suggested Blogs:

- Backward in time through a treatment

- Learn with Mentyor’s Accounting Assignment Help and Finance Assignment Help

Recession 3.0 in 1991 – PANDEMIC DID NOT BRING RECESSION 2020

The factors that led to the recession of 1991 was the restrictive monetary policy of the Federal Reserve of US and many other Central Banks of different countries. The restrictive monetary policies enacted were majorly in response to concerns of inflation.

After the 1990 oil price shock there was a loss of consumer and even of business confidence. One of the major events that occurred during that time was the end of cold war.

Many economists regard the end of cold war behind the cause of recession as it resulted in the dramatic decrease of defense spending.

Recession 4.0 in 2009 – PANDEMIC NOT THE CAUSE OF RECESSION 5.0

In the year of 2007-2009 the recession was more called as a financial crisis. The economic flop started when US Housing market collapsed which resulted in the mortgage-backed securities to crash because of the loss in their value.

The Federal Reserve lowered its interest rates to maintain economic stability in the country, after the 9/11 attacks on the United States. From the year 2004-2006, it was marked that interest rates increased at a steady rate to target inflation. Due to this, the credit flow in the housing sector normalized.

The recognized housing bubble was followed when the banks started advancing exotic loans on adjustable securities. Things started taking pace for the crisis after the bankruptcy of Lehman Brothers, who was the US’s fourth largest investment banker.

The fall of Lehman Brothers spread further to other economies of the world, particularly in Europe. The direct impact was felt in the economy when around 8.7 million people lost their jobs.

RECESSION 5.0 in 2020 – PANDEMIC DID NOT BRING RECESSION 2020

Recession 5.0 or the 2020 recession as suggested by the economist took place due to various reasons. It can be said that covi-19 pandemic is one of the reasons behind the recession in the global economy.

The pandemic caused many disruptions in the trade activities of many countries. COVID-19 drastically hit the industries like the manufacturing sectors, tourism sectors etc. Due to fluctuations in trade business confidence fell to a new low.

Second reason that might be a reason behind the recession is the trade war between US and China. The drastic effect of this trade war was the declining business activities amidst the pandemic.

Declining Investments

Another effect was the declining investments on the part of the investors as they fear US sanctions and at the same time China is one the fastest growing economy in the world. So being loyal to both these countries would help the investors and thus choosing sides would not be an option on their part.

The falling interest rates was another reason behind recession. Normally when interest rates fell due to the stagnant economy there was limited option left for monetary policy or fiscal policies to work out.

The interest rates kept on declining that caused an economic depression resulting in recession.

What were the effects of recession 5.0 on the global economy?

We have discussed about the immediate effects of recession during the pandemic. Now it is time for us to see the overall impact of recession on the global economy.

Immediate Effect – PANDEMIC DID NOT BRING RECESSION 2020

The immediate effect that can be felt by everyone is the rise in unemployment level. Due to high rates of borrowing, increased product prices, fall in investment etc. overall the economy is badly hurt. This will lead to fall in personal disposable income o the public that further declines the per capita income and the national income. The fall of per capita income and national income will ultimately lead to economic depression.

Price Rise

When there is low level of investments due to high interest rates of the banks the cost of production increased. When the overall production cost increased the wage rate declined of the employees. So, another impact of recession was on the incomes of the general public. The rising prices of goods and services with low level of incomes adversely affected the economy turning it towards a financial crisis.

Borrowing – PANDEMIC NOT THE CAUSE OF RECESSION 5.0

To balance out the high interest rate due to non-availability of money, government turns towards borrowing from external sources or from internal sources. These borrowing adds up to the burden on the part of the government that will take a turn towards a financial crisis on the country.

Poverty

Another effect of recession apart from economic depression and financial crisis is poverty. The non-availability of credit for production cycles, reduce investment which has direct impact on the salaries and wages of the workers. Due to decline in wages and salaries the purchasing power of the people gets reduced that has an impact over demand and supply (the market forces). When the market forces get affected then recessions or economic crisis is bound to happen.

Increment in Gap – PANDEMIC DID NOT BRING RECESSION 2020

There are different classes of people living in our societies depending on their income. Some are salaried classes others are daily wage earners. When the economy faces recession or economic depression, the daily wage earners are vastly affected. This widens the gap between the two classes of people. When the gap widens there is an increased inequality in the society.

Business Closures

Another impact that we can see when there is recession is the decline in output and business closures. The decline in output is because of the increased cost of production and increase in the level of fixed cost. Many business houses cannot afford this cost of operations that lead to closure. We have seen this type of shutdown of business houses in our recent past i.e. during the pandemic.

Social Schemes – PANDEMIC NOT THE CAUSE OF RECESSION 5.0

One positive outcome that we can think about amidst these negative impacts is that government can utilize its funds on social schemes. The funds utilized under social schemes can have prolonged benefits even after the economic depression or the economic crisis. The positive outcomes of these social schemes are taken by the daily wage earners. Sometimes it also becomes difficult for the government to fund these social schemes. Therefore the government resort to borrowings either internally or externally.

How does the government tackle recession?

There are certainly many ways through which the government curb recession.

Fiscal Policy

Government through borrowings can influence its own spending’s called as government spending’s or through a tax cut that can affect the real personal disposable income. During the financial crisis or recession government can spend on the new infrastructural projects that will ultimately increase the employment level and help the daily wage earners earn their own living.

Through proposed tax cuts the government can increase the money in the hands of the general public so that demand increases and lastly inflation targeting can be done.

Monetary Policy – PANDEMIC DID NOT BRING RECESSION 2020

The Central Banks of different countries can introduce cut in the interest rates that will make the borrowings from financial institutions cheaper. This suggest that more people can take loans from the banks and the liquid cash is available in the hands of the public. One thing in this situation should be kept in mind that printing of new currency notes may not always be the best alternative available for the government.

Helicopter money or printing of new money can increase in the general price level as demand will increase that will directly affect the supply.

Supply-side Policy

Government should focus on improving productivity by promoting laissez-faire economy. This will not only increase the productivity but also affect the efficiency in the economy.

Government spending on education, training, research and development will not only benefit the society but also increase the social benefits that is accrued by the poor people.

Governments of different countries

Now, the question arises that what was done by the governments of different countries to tackle recession during the pandemic? The answer is always not easy as the government needs to look into every aspect of the society. Let us try to know what policies were adopted by the government during the pandemic. One of the critical steps that was adopted during this time was the declining of the interest rates. This emergency step was taken by the Bank of England and Federal Reserve of the US. Cut in the interest rates provided some relief to the business and homeowners.

Secondly, one policy that was adopted by the White House was that of income tax cut which will increase the personal disposable income of the public. Third is that of creation of separate funds for unemployment benefits or sickness benefits. Government focuses on the ways how to easily curb these benefits so it can be used by the public. Lastly in the form of expansionary fiscal policy the government starts spending on public projects. These public investments can increase employment levels and also benefit the daily wage earners.

How can stock markets rebound?

Another question also arise, after the lockdowns were lifted how can stock markets rebound? The simple answer to it was the increase in the investors. Specially in the age group of 18-35 the investors increased during the time of pandemic. It was reported from Bombay Stock Exchange, India the oldest stock exchange in Asia, that the investor base had a paradigm shift to 75%. Another fact surrounding the rise in stock markets that the investors were mainly from Tier 2 and Tier 3 cities of India.

Comparison between Economies

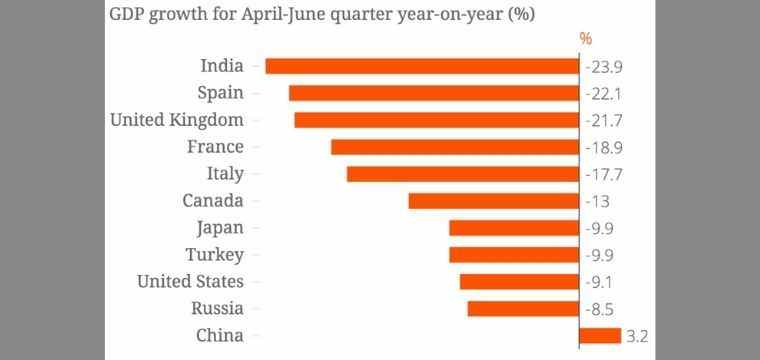

If we only see the data, we will find that the global economy was hit hard by the pandemic. Every economy whether big or small was hit by recession, economic crisis, financial crisis during the Covid-19. Barring China, US, UK, France, Germany, India have felt negative impacts of the global pandemic.

CHINA – PANDEMIC DID NOT BRING RECESSION 2020

Chinese economy is the only economy in the world that has grown by 3.2% during this lockdown and specially in the April-June quarter of the financial year. Economists suggest that the Chinese economy is growing faster due to intensive anti-disease measure imposed the government in the country.

UK – PANDEMIC NOT THE CAUSE OF RECESSION 5.0

It was reported by the government that there has been a contraction in the economy by 21.7% in the April-June quarter of 2020. The reason behind such a contraction of the economy was the strict lockdown measures put forward by the government to ensure the control of the virus as Britain was one of the worst hit countries. Maximum industries, retail and wholesale, manufacturing units were shut, therefore the industries were total shut.

FRANCE – PANDEMIC DID NOT BRING RECESSION 2020

France had a contraction in GDP by a record of 18.9% for the April-June quarter. The GDP numbers were expected to be much low; the economic performance of the country was worse when compared to other European countries.

US – PANDEMIC NOT THE CAUSE OF RECESSION 5.0

This economy not only suffered the numbers according to GDP projections but also according to the number of deaths and the total number of infected persons on a daily basis. US economy contracted by 9.1% for the April-June quarter of 2020. This was the lowest shrink that happened in US since 1947.

CANADA – PANDEMIC DID NOT BRING RECESSION 2020

The contraction of the Canadian economy during the crisis was 13% as reported by CEIC. The reason behind such contraction was the fall in customer spending, fall in investments during the lockdown, fall in exports during the trade restrictions that were placed during the pandemic.

ITALY – PANDEMIC NOT THE CAUSE OF RECESSION 5.0

Italian GDP too went for a toss in the quarter of April-June 2020 and it was reported that it shrank by 17.7%. This number is lowest when compared to the fall in GDP of the first quarter in 1995.

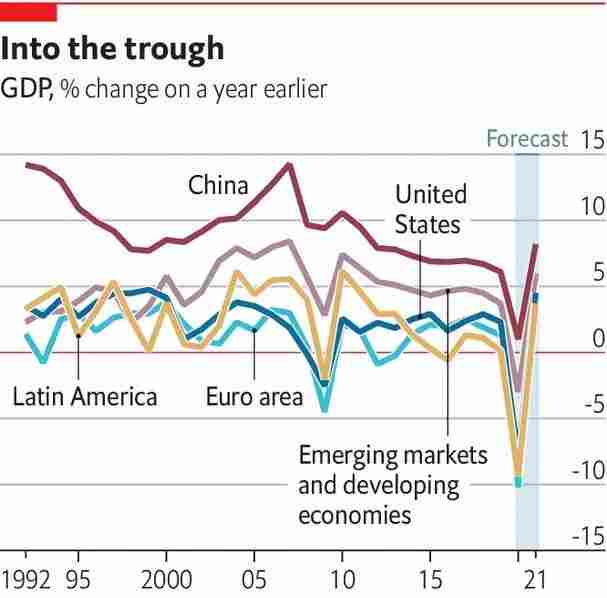

Reports of World Bank

According to the reports of the World Bank, it is reported that the global economy will shrink by 5.2% by the end of the year 2020. It is considered by many economist and International Monetary Fund and also the World Bank as the deepest recession since the second world war 1939-1945.

The emerging economies or the developing countries will face a tough situation as their economies will shrink by 2.5%. The advanced economies will face the sharpest decline of 7% for the year 2020.

By the diagram, we can see that India has the largest contraction of economy i.e. 23.9% while China has showed an increase in GDP for the April-June quarter of 3.2%. The economies to face such major contractions is mainly due to the reason of lockdown imposed by the governments.

Downward Trend of GDP

The downward trend of GDP shows how the major economies are moving towards recession and economic slowdown.

By the diagram, we see the economic crisis that had altered the phase of developments in many economies that it the developed economies and as well as the emerging markets. The trend shows the fall in GDP from the year 1992 to 2021. The largest decline of GDP is seen in 2020 which is measured to be around 10% for April-June quarter.

Recession 5.0 or the 2020 recession was due to a numerous factors and pandemic was the primary among them all. We can say that the recession was caused due to interconnected reasons. First due to pandemic, the governments had to impose strict lockdown due to which production, trade and the market forces were affected.

Further it led to a situation where the major economies were in the verge of economic crisis displaying a crisis of major financial unrest. The financial crisis further adhered to economic slowdown. The mixed effects of all these crisis led to a situation what we call now as recession.

WhatsApp

WhatsApp