Mutual Funds (MFs) have provided a noteworthy contribution in the overall growth and development of the World Economy and Financial Market ever since its introduction here. However, a good deal of questions in this regard still remains unsettled on today’s date. What exactly are MFs? When is a good time to invest in them? Are there any tax benefits? The Best Mutual Funds to invest in and What were the Best Mutual Funds in 2020? What are ETFs: Mutual Funds vs ETF. We shall find out more about these questions below.

WHAT ARE MUTUAL FUNDS ?

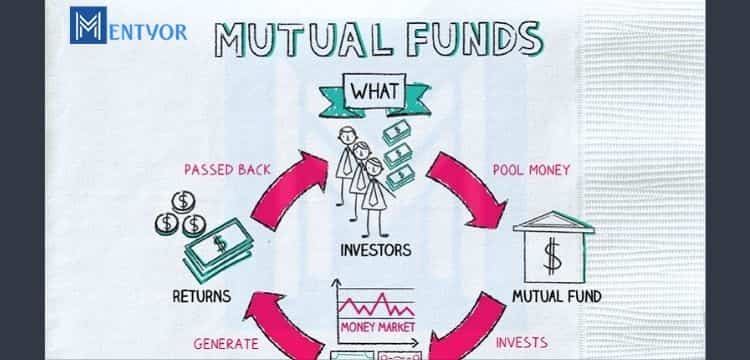

A Mutual Fund can basically be defined as a type of financial vehicle wherein money is collected from various investors. And then that pool of money is used to create a portfolio of securities where such money is invested like stocks, bonds, money market instruments, and other assets.

Mutual Funds are created and managed by a Company and run by a professional Money/Fund Manager. It is basically an investment product. It pools the resources from retail investors, thereby increasing participation of multiple investors in the financial markets. Diversification of MF schemes has allowed more investors to come in and pool their assets.

On an average, some people save 30% of their salaried income; and Mutual Funds provide a good investment opportunity for them to bank their savings in and earn a lucrative return thereon. Then what is the best time to invest in them in order to bag paying returns? Well, there is no thumb rule or fixed criterion to determine the best time to invest in MFs. This is because it provides stable returns throughout its life, earning from a diversified range of equity and debt instruments. However, if investment is made in a MF when its NAV (Net Asset Value, that is, basically the market value of each unit of MF) is low, then it can maximize the returns and lead to higher wealth accumulation for the investor.

TYPES OF MUTUAL FUNDS

There are various types of Mutual Fund Schemes that are available in the market. This categorization is done based on the kind of securities they have invested in for their portfolio. The most common types include-

Equity Funds

These are the largest category of MFs as they primarily invest in stocks. These funds can be sub-categorized based on the size of the companies they invest in- small-cap or mid-cap or large-cap.

Fixed Income Funds

These funds focus on investments that pay a set/fixed rate of return, like government-bonds, corporate-bonds, or other debt instruments. The fund portfolio generates interest income, which it then passes on to the investors of the MF.

Index Funds

Another popular type of MFs is the Index Funds. Their overall investment strategy is based on the belief that it is difficult to beat the market consistently. So, an Index Fund Manager typically buys stocks that correspond with a major market index such as Nifty.

Balanced Funds

These funds invest in a hybrid of asset classes, for example, stocks, bonds, money market instruments, or alternative investments. The key objective here is to reduce the exposure risk across all asset classes.

Money Market Funds

These funds consist of short-term debt instruments, mostly government Treasury bills. These are risk-free; hence, they earn lesser ROI.

There is another variation of Mutual Funds, Exchange Traded Funds (ETF), which is basically a twist on mutual funds. We shall discuss about Mutual Funds vs ETF later.

WHY MUTUAL FUNDS ?

Diversification is the greatest benefit of MFs. A small investment in MFs can give you access to hundreds of stocks and bonds which would have been impossible for you to access individually. To some extent, it can be said that there is sharing of investment expenses because each investor individually contributes only a small fraction of the total portfolio amount. And he gets proportional returns on his invested amount.

This level of contribution from a number of retail investors together leads to economies of scale and brings in operational efficiencies in managing the fund. Also, MFs are managed by a dedicated team of professional Fund Managers whose work revolves around researching and analyzing about the current and potential holdings. So, it saves a considerable amount of time and resources of the individual investors as they no longer have to dedicate their energies behind the analysis of their investments.

Another benefit of investing in MFs is that it can lead to tax savings. Lastly, mutual fund investments provide liquidity to the investors so they can withdraw their invested amount with considerable ease.

MUTUAL FUNDS vs ETF: A COMPARISON

Mutual funds vs ETF (Exchange-traded funds) are essentially the same. They both consist of a portfolio of many different assets and are a means for common investors to diversify their funds. However, there are key differences between the two.

Mutual Funds vs ETF can be differentiated based on the manner in which they are managed. ETFs can be traded like stocks, while mutual funds can only be purchased. Such purchase of MFs can typically be executed at the end of each trading day based on a calculated price. MFs are “actively managed”, which means that the Fund Manager makes most of the decisions about how to allocate assets in the fund.

ETFs, on the other hand, are usually “passively managed”. That is, ETFs are simply based on a particular market index. MFs tend to have higher fees and higher expense ratios than ETFs, reflecting, in part, the higher costs of being actively managed. In contrast to MFs, ETFs offer greater tax advantages to investors. This is because, being passively managed portfolios, ETFs (and index funds) tend to realize fewer capital gains than actively managed MFs.

Depending on the time-frame, risk appetite and financial goals, an investor can decide which option is better for him. While the essence of both these funds is similar, a healthy and wise mix of Mutual Funds vs ETF can prove to be extremely beneficial to the investor’s investment portfolio.

BEST MUTUAL FUNDS 2020

How to find out what are the Best Mutual Funds to invest in? What were the Best Mutual Funds in 2020? Well, the fitness of a particular Mutual Fund is tested primarily based on the returns that the fund earns for its investors compared to the benchmark performance.

A Mutual Fund that earns higher returns than the benchmark, can be considered as a good fund. Such returns earned by MFs can be considered on per-year basis, as well as for a longer term, say over a 5-year period. Secondly, expense ratio of the fund can be analyzed. Expenses like securities transaction fees, distribution charges, management fees, etc. are considered for the calculation of the expense ratio. Lower the expense ratio, the better it is for a MF. Another important performance indicator is the fund’s history.

A trend analysis of the fund and its performance corresponding to the market can be studied in depth. This could give a decent picture about the overall performance of the MF. Based on an article published by investors.com, the Best Mutual Funds 2020 in the US can be listed along with their annual returns as follows (as against the Benchmark set at Standard & Poor’s 500 Index, that is, S&P 500 Index that gave an overall return of 31.49% p.a.)

NAMES OF BEST MUTUAL FUNDS 2020

- Virtus KAR Small-Cap Growth I – 40.26% p.a.

- T.Rowe Price New Horizons – 37.71% p.a.

- Fidelity Advisor Growth Opps M – 39.95% p.a.

- Akre Focus Instl – 35.35% p.a.

- Fidelity OTC – 39.22% p.a.

- Morgan Stanley Insight I – 33.40% p.a.

- Lord Abbett Micro Cap Growth I – 34.56% p.a.

- Fidelity Growth Company – 38.42% p.a.

- Edgewood Growth Instl – 34.18% p.a.

- Wasatch Ultra Growth – 38.06% p.a.

- AB Small Cap Growth A – 35.77% p.a.

- Federated Kaufmann Small Cap A – 33.97% p.a.

- Virtus KAR Small-Cap Core I – 40.19% p.a.

- Baron Partners Retail – 44.99% p.a.

- Principal MidCap R5 – 42.67%

- Glenmede Quant US Large Cap Gr Eq – 34.84% p.a.

- Delaware Smid Cap Growth A – 35.33% p.a.

- Janus Henderson VIT Enterprise Instl – 35.48%

- Fidelity Blue Chip Growth – 33.44%

- JPMorgan Growth Advantage A – 35.81%

The above list of Best Mutual Funds 2020 has been prepared considering the primary performance indicator (returns) as well as the other indicators (like expense ratio of the fund, fund history, etc.). So, that was all about how the investors can determine the Best Mutual Funds to invest in. Also, some of the Best Mutual Funds of 2020 have been listed above. However, before an investor decides what the Best Mutual Funds for him are, he must be distinctly aware of his financial objectives and his risk-appetite. With that understanding, he can make right decisions about the Best Mutual Funds and can achieve wealth maximization.

WhatsApp

WhatsApp