Are you more prone these days to opt for online payments? Do you enjoy the scratch cards and wide ranges of offers available through your digital bank accounts? As much as we love to be out and use the cash, we cannot deny how digital payments have made lives easier. With a matter of a few clicks, we can order and buy our desired food, articles and more.

Digital payment is the prominent option that most of the companies are seeking these days. This is due to its relevance, accessibility and the widespread use of technology. The digital payment advantages are yet another reason why many of us have opted for it. With payments being digitised, it becomes easier to handle last minute purchases.

The whole concept of this revolves around the principles of convenience and how technology can be a boon. Tracing the entire history of digital transactions is essential to understand its current growth. Today, right from the small retailers to huge organizations, digital payment is prevalent everywhere. Infact, digital payment is one of the strongest backbone of various e–commerce sites.

There are several examples which better illustrate and trace the shift from physical to virtual payment methods. In the below set of information, there will be a complete understanding to the history attached regarding what is digital payment. There will be a holistic illustration on digital payment and its current growth. Further, there will be various advantages and disadvantages of digital payment that would be highlighted. Lastly, there will be a take on the relevancy and convenience of payment through its various examples.

Read our blog about Cryptography: Cryptography – A key to Secure Communications

Takeaway

Payment methods have gone through significant changes. Today, the payment methods are not only physical but digital too. This has given enormous popularity to the concept of digital payment.

History of Digital Payment

Digital payments were earlier considered by the term ‘electronic payment’. The whole concept of electronic payment is said to have been present since the 1870s. This entire transfer of money digitally, had made the people to transact various amounts for goods and services. And all these can be done without them being present at the moment physically.

In the United States of America, the first instance of digital payment was considered to be telephonic (1). At that time, digital payment sufficed to only payment through debit or credit cards. The keypad to add the pin for the debit cards, resembled those on a public telephone booth. All these payment methods started off in the first half of the twentieth century (1).

The journey of electronic payments from the 1870s kept transforming. The essential tool to do so was technology which is still the main factor for various developments in the domain. In 1910, the telegraph method was used to transfer various payments. In the 1950s, the entire payment had shifted to crest cards. Later, in 1959, in the United States of America, plastic cards were coined to be the crest cards.

The use of cards slowly replaced digital methods. In the 1970s, computers were the driving forces to complete the payments for various purchases. In the late 1990s, online banking options were made available to the people.

With the advent of the online banking options, the actual shift of payment had taken place. People relied on computers, websites, and technology to pay the amounts from their bank accounts. This was further facilitated by the development of various versions of the Web.

The places that had more accessibility to the internet were already experiencing the markets prospering virtually through digital platforms. In 1994, the first pavement for e-commerce through digital payment was carved. Amazon, one of the leading e-commerce site, started its online purchase, and payment services.

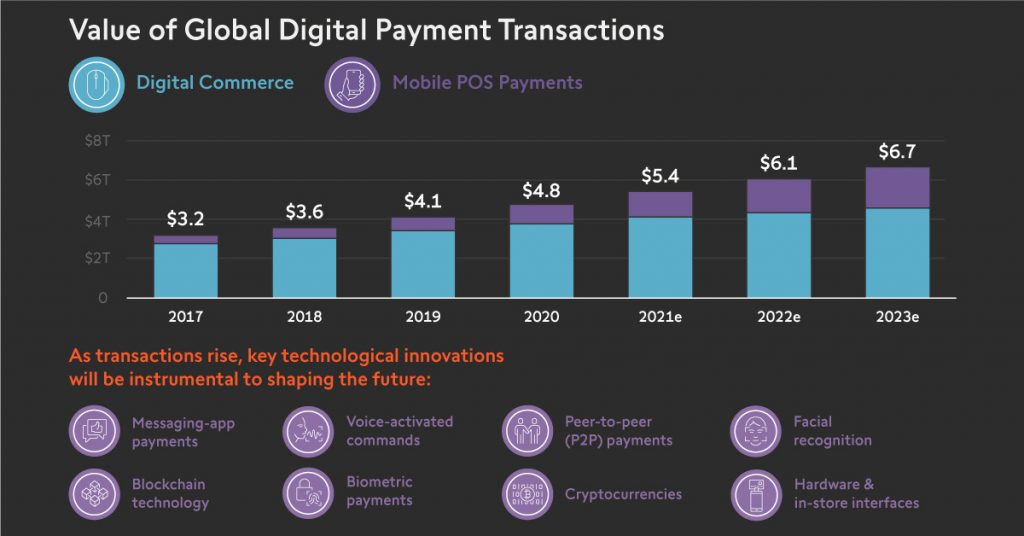

Currently, more than 78% of Americans rely on any one type of digital payment (1). In most of the country, payments are classified to be either semi-digital or semi-physical. In an Indian scenario, various digitally payment companies like Bhim, Google Pay, etc have dominated the payment methods. Further, PayPal. Mastercard, Visa, are the leading companies that are providing proficient services around the globe.

If comprised in a nutshell, the story of digital payment has shifted from various payment mediums to convenience. Earlier, these payment methods were introduced as a means to explore the types of payment that can be available. However, today, digital platform are more about how convenient payment can be and what security it holds.

Takeaway

The earliest existence of digital payment was through the concept of electric payments. This evolved from use of telegraphs, crest cards, debits cards, to online banking systems and e-commerce purchases.

Read our blog about Blockchain: Blockchain – The Most Talked Technology of today’s Era

What is Digital Payment?

In the simplest meaning, digital payment is defined as the payment mechanisms which take place beyond a physical presence of cash. In other words, it is the payment that we make without using the cash in hand. The cards, QR codes and various pins of mobile banking apps are used for the payment purposes. In this shift to digital platforms, the major role is executed by the internet. The Internet has bound the banks to various organizations, ventures and this is further connected to the customers. The internet is the source for various banks to open up their mobile banking apps. These mobile banking apps provide the authenticity and manageable data for the payments that are made digitally.

To avail a particular digital payment mechanism, the agencies or the companies make use of a ‘decision-maker-centric approach’ (2). In this kind of approach, a specific company channels out its payment mechanism based on the customers that are available for it. It analyses all the factors that would affect its possible investments and revenue models. This includes whether the customers have prior knowledge about digital payment, the resources available and others. Further, it also includes the internet users and the kind of customers that visit the organizations.

For digital payment methods, there must be a survey and analysis to build the website. Most of the companies create their own channel for payment which is securely routed from their websites. The websites not only work to provide an overview about the products or the companies, it is also the organic channel for payment. It becomes easier for a company to manage its data for payments. With this, the amounts get directly funded to the company’s authentic account without any mishaps.

Digital payment can begin as one and then branch out into two or more for the companies. With the right evaluation and calculation, a company would decide whether it would open more digital payment options or not. This have eased out lives and provided access to every necessity in the least time possible.

For instance, if you are running out of time and cannot afford to be at a restaurant, you can avail food services and clear it up digitally. Similarly, if you have no time to look out for your medicines and purchase them, you can do it with the respective e-commerce site and pay digitally. With digital payment, availability of basic resources have become relatively easier.

Digital payments have also minimized the cash in hand. It has transformed the selling-purchasing model for the customers and sellers. With various options of cards, scanners and pins, customers do not require to have cash all the time. They can use these cards, pins or scan to make their payments. This method of digital transactions has become more convenient in times of emergency, especially when there are savings in the accounts and least cash in hand. For the sellers, managing the amount has become easier.

They do not require to have the lockers for the cash all the time. The amount paid virtually should be linked to their accounts, and the money will be credited there automatically. Further, digital payment secures the misplacement of amount by the sellers and gives them the data with all the specificity.

This type of payments have truly changed the vision of how we viewed payment methods earlier. However, despite the long list of digital payment advantages, there are still fall outs and developments required. In this digital payment essay, the further information will illustrate the advantages and disadvantages.

Takeaway

Digital payment is the method of payment done virtually. It has provided convenience to both the sellers and the customers. A complete digital payment plan has to be hatched before its implementation.

Advantages of Digital Payment

Digital payments have created a wide path for the markets available globally. There are various advantages that are linked to this. These payment advantages are discussed below in detail.

Strictly Secured

With digital payment methods, the entire payment process is secured. It is secured on the basis of the ‘end to end’ principle. The consumers find this secure since it provides them to pay, without carrying too much cash. Further, it also provides them with the reliability check of the entity they are paying to. Similarly, for the sellers or marketers, it directly credits the amount to their account and they do not need to hold it physically. Further, it provides them with the details of the paying entity.

Smooth Transactions

With digital payments, transactions become easier and smooth. All you need is good connectivity, the payer’s id, your bank details and the transaction becomes successful. The smoothness of transactions also ensures that this type of payment is beneficial to the senior citizens too. Further, the transactions made are recorded and can be checked by us, in order to keep a track of our account balance.

Convenient to All

It is synonymous to convenient payments. The entire concept of digital payment thrives today, for its provision of convenience. With this payment method, you can make payment from anywhere, be it your home or office. A person does not require to be physically present at a shop or a hospital to make the payments. They can sit in the premises of their homes and pay. Further, the payments are not only restricted to shops. With this, you can pay your bills, and other expenses too.

Wide Range of Payment Options

One amongst the digital payment advantages is the wide range of options available for paying. Digital payment is not just restricted to debit cards or credit cards. The payments can be made with QR codes, Pins set in banking apps, or various mobile banking options. This is especially helpful when your preferred option does not work out. In case of such discrepancies, you can always try out the other options and complete your payment successfully.

Availability of Offers and Discounts

With digital payment, there are various offers and discounts made available. If you frequently pay through the digital platforms, you can avail to various offers and discounts. This also includes cashbacks, rewards and scratch cars. All these bounties can be availed by you on your next purchase at the particular digital platforms.

These are some of the digital payment advantages. These advantages are both customer and seller centric, providing convenient maximisation.

Takeaway

The digital payment advantages are:

- Strictly Secured

- Smooth Transactions

- Convenient to All

- Wide Range of Payment Options

- Availability of Offers and Discounts

Read our blog about Cybersecurity: Cybersecurity – Ways to protect your network

Disadvantages of Digital Payments

Just like the other side of the coin, there are various disadvantages . These disadvantages are elaborated below.

Privacy Complications

The digital payment methods seem to be secured but only to an extent. Once the information about the accounts are filled in, it can be hacked and may be visible at a larger extent. The details may also be transferred to a wrong authority, which can increase the possibilities for cyber crimes. It can also lead to scams and fraud calls in the name of bank authorities.

Delayed or Incomplete Transactions

Using digital payment methods can sometimes lead to delayed or incomplete transactions. That is, due to network issues or server interruptions from the bank’s side, the transaction to the specific entity would not reach. If the transactions fail, it becomes a huge task to retrieve the amount into the account again.

Increased Charges

If you wish to pay through the digital mode, you might have to incur huge charges. There would be additional charges for packing, delivering and other miscellaneous activities. Further, the process of transactions would also require charges that are usually credited to the banking apps or other relevant apps.

Requires Strong Internet Networking

For digital payments to be successful, there is a requirement for a strong internet connectivity. If the internet connection lags or staggers, the transaction process would be interrupted. In a situation where there is complete loss of internet connection, the payment would be unsuccessful. As a result, the entire convenience of payment would be lost.

These are the digital payment disadvantages. These disadvantages indicate the areas of development and improvisation that are required for digital payments.

Takeaway

The digital payment disadvantages are:

- Privacy Complications

- Delayed or Incomplete Transactions

- Increased Charges

- Requires Strong Internet Connectivity

Read about Cryptocurrencies in Metaverse: Investing in the Metaverse: Different Cryptocurrencies in Metaverse and Technology Behind

Parting Note

In the above information, there is a complete understanding about what is digital payment. The concept of this has evolved from the early concept of electric payments. Earlier, cards were used as the first instance for digital payments. Today, it has expanded to apps, QR codes, and pins. There is also a shift in the first and current use of digital payment. The early use of digital payment was to know the possible mediums for payments. However, currently, digital payment is used for convenience and easy transactions.

The above article also takes a holistic view on the advantages and disadvantages. Further, it elaborates on the entire thriving of payment through various digital examples. The article also discusses how digital payment has simplified life and the market world with relevant facts.

Commonly Asked FAQs

- What do you mean by digital payment?

In the simplest meaning, digital payment is defined as the payment mechanisms which take place beyond a physical presence of cash. In other words, it is the payment that we make without using the cash in hand. The cards, QR codes and various pins of mobile banking apps are used for the payment purposes. In this shift to digital payment, the major role is executed by the internet.

- What are the digital payment advantages?

The advantages are:

- Strictly Secured

- Smooth Transactions

- Convenient to All

- Wide Range of Payment Options

- Availability of Offers and Discounts

- What are the digital payment disadvantages?

The disadvantages are:

- Privacy Complications

- Delayed or Incomplete Transactions

- Increased Charges

- Requires Strong Internet Connectivity

References

[1] Digital payment technology and the history of telephone interface

[2] MacKie-Mason, J. K., & White, K. (1997). Evaluating and selecting digital payment mechanisms. Interconnection and the Internet, 113-134.

[3] Top 10 Benefits of Digital Payments – Why Seniors Must Go Cashless

WhatsApp

WhatsApp