In recent times, the concept of digital payment has seen enormous growth. Both the developing and developed countries are continuously strategizing to shift towards a digital payment mode. The prominent reason to avail of the digital payment methods is due to its convenience and save of time. Today, the scenario of the digital payment system has changed from necessity to a revenue model. The digital payment platforms look out for extracting optimum revenue after providing the services. This is why the concept of the digital payment business has been gaining prominence. The entire tracing indicates how digital payment continued to evolve with the additions to technology.

Today, the digital payment business is one of the key escalating forces of an economy. For developed countries’ economies, the digital payment business model is a new start. For developing countries, the digital payment business model acts as a new opportunity for economic growth. In this entire process of how the impact of digital payment on the economy is, various underlying factors affect it. Further, there are also factors which may act either as an opportunity or constraint for complete adoption of digital payment in an economy.

Digital payments are inclusive of various services and payment methods. Understanding them briefly is important to know how they impact the economy. In this article, there will be a brief explanation of what digital payments are. Further, there will be a complete elucidation on what is the impact of digital payment on the economy. There will also be a detailed understanding of what factors can promote or reduce the chances for setting up a complete digital payment model. This will be further analyzed based on the two major types of economy- developing and developed economy.

Read our blog about Cybersecurity: Cybersecurity – Ways to protect your network

Takeaway

In recent times, the concept of digital payment has seen enormous growth. Both the developing and developed countries are continuously strategizing to shift towards a digital payment model. This has given rise to the concept of digital payment business.

An Overview on Digital Payment

Digital payment and its concept revolves around paying cashless and through the virtual mode. It comprises the services and the payment methods that are all digitally dissipated to the users. In a general pattern of digitally paying, a user has to link their accounts with the mobile banking apps. Once it is done, they can make use of the mobile banking app to pay at any place and when required.

Digital payments bring in the same essence of being at a store but virtually. All the digital payment services can be availed without being at the store. Currently, the services provided by the digital payment methods include recharges, bill payments, e-commerce shopping, payment to contacts and more. In addition to that, the digital payment platforms have als inculcated the secondary features of the markets. They provide exciting offers, discounts, rewards and cashbacks.

The advent of digital payment has seen a shift in consumer and seller behavior. Earlier, customers were witnessed in long queues, either to buy at a store or pay their bills. However, with digital payment, they do not have to be at the place physically. The payments can be done from anywhere. Further, the bargaining pattern amongst the customers has seen a complete invalidation. The customers seem to be absolutely fine in availing the prices available through digital payment mode.

The key forces that promote digital payment are convenience, security, feasibility and wide range of options. Digital payment provides the comfort of making payments from anywhere, considering the availability of necessary resources. It is feasible in terms of its usage. The steps to create an account or pay digitally are not complex. They can be understood or taught in a matter of a few minutes or an hour.

Digital payment provides secure transactions to both the customers and the merchants. It gives a platform to have a virtual account and pay through it, rather than carrying cash in hand. Further, digital payment platforms are infused with a wide range of options. These options pertain to offers and various payment methods. If one avails to pay digitally, they can pay through cards, USSD, UPI pins, QR codes, etc.

To summarize, digital payment methods have brought a change in how people look at paying. This very feature has advanced various mobile banking apps to release a digital payment business model. Today, digital payments provide convenience, however, they also are a strategy to advance revenue and generate income.

Takeaway

Digital payment and its concept revolves around paying cashless and through the virtual mode. It comprises the services and the payment methods that are all digitally dissipated to the users. It is an amalgamation of needs, solutions and services to the users.

Read more about Digital Payment: Payment Revolutionized: Know All About Digital Payment

How has Digital Payment Impacted the Economy?

In analyzing the impact of digital payment on the economy, two types of economy are to be considered. The economy can be classified based on the development of a country. There are two types of economy- developed and developing economy. Developed economy is the economy ranging for developed countries like USA, Australia, China, Japan. Developing economy is the economy for developing countries like India, Bangladesh, Guinea, and more.

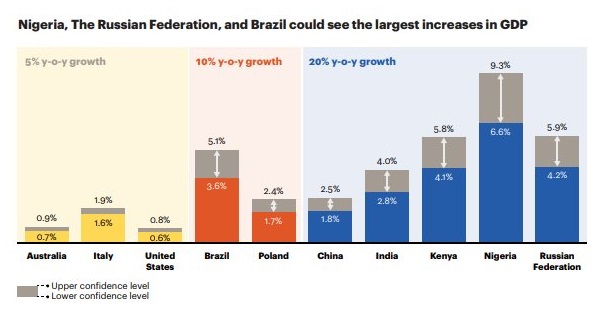

Digital payment business has seeped into both developing and developed economies. Developing as well as developed countries are familiar to the working and aim of digital payments. The economy of digital payment is classified as digital economy (1). This digital economy is all about the digital payments and transactions that take place. The digital economy is calculated as a contributor to the global economy (1). According to the studies, digital payment is said to be a connection of data, people, payment, services, and information (1).

The digital payment business for the developed economy is considered to be a progressed attachment to the economy. This is because the economy is already developed. The intervention of digital payment becomes a modern assistance to the people. It is a kind of provision of upgraded technology in exchange for the continuous growth in the economy. For a developed economy, the installment of digital payment business is relatively easier. This is because there is already an availability of the resources and the requisite technology. Also, for a developed economy, the idea and execution of a native digital payment platform is easier.

The developed economy has relatively witnessed an increased use of digital payment methods, earlier than the developing economy (2). With each year, there is a growth in digital payment users. People are finding it more convenient to pay off their bills from home than being at the particular office to do the same. The recent outbreak of pandemic has only increased the use of digital payment methods in developed economies. It has been there already, but one factor, that is the pandemic is the cause for its wide recognition. The rigorous growth in internet users and the advancement in technology are the key forces. They are the reasons for long-term usage of digital payment in the economy.

For a developing economy, the advent of digital payment has been relatively slow. The idea as well as execution of digital payment business model has shot a growth after the pandemic. The situation had pushed the developing economies to look for virtual options of transactions and payments. While the idea of paying virtually has already been three through plastic cards (credit and debit cards), the elaboration to it came later.

It is only recently since 2017 that developing economies such as India, have adopted various payment methods for digital payment (2). The major reason for a slow growth in digital payment in developing economies is lack of knowledge. There is a vague or developing understanding of the internet, technology and resources. It is only in recent years that digital payment business model have come up and are contributing to the economy.

The impact of digital payment on the economy is still a long way to go. The digital economy and its contribution to the global economy are highly dependent on various factors. These factors in terms of two types of economies, are explained and understood in the next section.

Walmart in Metaverse? Read more: Is Walmart planning for Metaverse next?

Takeaway

Digital payment business has made the digital economy a major contributor to the global economy. For a developed economy, the advent of digital payment is a new prosperity to advance in terms of finance and technology. For a developing economy, digital payment business stems from new opportunities to enhance the economy and bridge the uneven economic gaps.

Factors Impacting Contribution of Digital Payments on Economy

The concept and practice of the digital payment business model has a humongous impact on the economy. It has brought in revenue, more assets with its seamless transaction feature. In addition to that, maintenance of balance through digital money is a more secure option for individuals as well as banks.

However, in this process of contribution to the global economy, there are various factors that affect the digital payment methods. These factors in turn indicate possible effects to the overall contribution to the economy. The factors are explained in detail below:

Technological Progress

For the digital payment business model to prosper, continuous technological progress is essential. Technological progress will indicate how the digital payment models can be modified over time. This would also indicate how relevantly they are used and are available to the people. For a developed economy, achieving the targets of technological progress are relatively easier. However, for a developing economy, a lot of efforts and finances would be induced in achieving technological advancement. Further, in some instances, the developing economy would require the assistance of the developed economy in achieving the technology to enhance digital payment business.

Financial Aid

Finance is a major factor to determine whether the digital payment models can run in a long-term period. For a digital payment model to be contributing to the global economy, it must have the financial backup. The fincinace part is also indicative how well the digital payment business can be run. Again, the financial part of maintaining a digital payment model is hugely dependent on the average income of the country or a particular economy. The income determines whether the economy can fund the digital payment ventures. This in turn would indicate whether there will be a major or lagging contribution by the digital payment platforms.

Awareness and Application

The prosperity of the digital payment business model is highly dependent on its awareness and practical usage. That is, there must be circulating information about the usage of digital payment platforms. These digital payment platforms and their plans must be known to the people so that customer reach to them increases. Further, the practical usage of these digital payment platforms must be practiced. The gap between knowing these digital platform businesses and practically them should be balanced.

In a developed economy, the gap is relatively less, as people know about digital payment and use them too. However, in a developing economy, either awareness or application could fall short. Sometimes, the people might know about digital payment but have no knowledge on how to use it. Or, sometimes, there might be a particular sector using the digital payment methods. This would be indicative of lack of awareness about the digital payment business model.

These are the factors that influence the progress and contribution of digital payment business in an economy. While the rate of contribution by the digital economy is on a rise, these factors indicate how it might get reversed. These factors also indicate how much the economy needs to assess before expanding or starting a new digital payment business.

Takeaway

There are various factors which stand as indicators to how well the digital economy might do. These factors are:

- Technological Progress

- Financial Aid

- Awareness and Application

Parting Note

In the above article, there is a brief introduction to what digital payment is. Digital payment and its concept revolves around paying cashless and through the virtual mode. It comprises the services and the payment methods that are all digitally dissipated to the users. In a general pattern of digitally paying, a user has to link their accounts with the mobile banking apps. Further there is an elaboration on the impact of digital payment on the economy.

The economy has witnessed a huge shift in contribution with the progress in the digital economy. This article studies the impact of digital payment on the economy based on the two main types of economy- developing and developed economy. While the developed economy has seen an advanced addition to the economy in the name of digital payment, it is different for developing economies. For a developing economy, there is still a scope left unattended to prosper digital payment.

This article also investigates what factors could possibly affect the digital economy and its contribution to the global economy. . These factors in turn indicate possible effects to the overall contribution to the economy. These factors are- Technological Progress, Financial Aid and Awareness and Application.

Commonly Asked FAQs

- What is the meaning of digital payment?

Digital payment refers to all kinds of transactions and payments that happen virtually. Digital payment and its concept revolves around paying cashless and through the virtual mode. It comprises the services and the payment methods that are all digitally dissipated to the users. In a general pattern of digitally paying, a user has to link their accounts with the mobile banking apps.

- What are the factors affecting the digital economy?

The factors that would affect the digital economy are:

- Technological progress

- Awareness and Application

- Financial Aid

- How does the digital economy affect developing countries?

For a developing country, the digital economy is a means of achieving higher technology. It is the oppoputrinty to take the economy on a higher scale of technology. However, the path to achieve full prosperity through digital payments is relatively tough. Different factors such as financial factors, availability of resources, etc, affect the course of progress in the digital economy.

References

[1] Kosimov, J., & Ruziboyeva, G. (2022). THE ROLE OF THE DIGITAL ECONOMY IN THE WORLD. Scientific progress, 3(2), 435-441.

[2] Ghosh, G. (2021). Adoption of digital payment system by consumer: a review of literature. vol, 9, 412-418.

WhatsApp

WhatsApp