Technical analysis has broadened its wings across different fields. Today, it is a very important step for various businesses, shares or stocks. Stocks are considered to be very important assets for any kind of corporation. They demonstrate the amount of partnership and ownership in the stock issuing corporation. This has given rise to another advancement, which is a technical analysis of stocks. It is done to understand where the stocks investment would bring in optimum profits. Apart from this, it also amplifies one’s technical analysis understanding. Knowing how to do technical analysis of stocks is very important, especially for someone new to it.

Technical analysis of the financial markets does much more than provide information about the potential investments. It also opens the door for corporations to predict their profitable future. However, as we know, the catch is to know how to do technical analysis of stocks. Therefore, knowing what stocks are and technical analysis of stocks should be the first steps. Let us know what stocks are first.

Read our blog: 7 Fascinating Metaverse Examples: Top Companies in Metaverse Right Now

Takeaway

Technical analysis has broadened its wings across different fields. Today, it is a very important step for various businesses, shares or stocks. This has given rise to another advancement, which is a technical analysis of stocks.

What Are Stocks ?

In the simplest sense, stocks [1] refer to the security which is indicative of the individual or venture’s share. This means that stocks are the fraction of security that an individual or the company holds and is the owner of it. This further makes the individual be the owner of the fractioned assets in the corporation where it holds the stocks.

The corporations issue the stocks to sell them and get funds. These generated funds are then used for the further operation of the businesses or ventures. The individual or the company that holds in the stock is known as the shareholder. The corporation is not that holds the stocks does not own the corporation. Instead, it holds a part of shares that are issued by the corporation. These corporations are considered to be the legal entities in issuing stocks.

There are vast distinctions between the corporations that issue stocks and their holders. The entire assets could be sold for the corporation if it goes bankrupt. However, for the shareholders, their shares would remain unharmed. The same process applies in contradictory situations as well. If the shareholder runs out of assets, it cannot use the corporation’s assets to complete its due.

Holding onto stocks gives various benefits. It assures you the right to vote in shareholders’ conferences. With it, you as a shareholder would receive the dividends or the profits from the company. Once the dividends or the profits are received, you as a shareholder would have the liability to sell them to others.

There are two types of stocks. These are – common and preferred stocks.

Common Stocks

In this type of stock, the shareholder has the voting preference in the shareholders’ meetings. With this, the shareholder can also ask for any amount of dividend. This dividend must be paid by the corporation and the shareholder has the final say for it.

Preferred Stocks

In this type of stock, the shareholder has no chance to vote in the shareholders’ meetings. However, in these stocks, there are more chances to have higher assets. Also, the shareholder can gain more than the shareholders in common stocks.

These are the common points to know about stocks. Let us know what the technical analysis of stocks is.

Takeaway

In the simplest sense, stocks refer to the security which is indicative of the individual or venture’s share. This means that stocks are the fraction of security that an individual or the company holds and is the owner of it. There are two main types of stocks– common and preferred stocks.

Books about Stocks, Read to know: 20 Best Books for Investing, Trading, Stock Market

What Is Technical Analysis Of Stocks ?

For beginners, analysis of stocks refers to studying charts and graphs for selecting stocks. It includes the studying of the charts and graphs that show the latest trends for stocks pickup. Accordingly, with the potential through charts and trends for stocks prices, further investments are done.

There are certain concepts or principles of technical analysis that are also common for technical analysis of the financial markets. In technical analysis of stocks [2], it is expected for the trending stock price to return. This emphasis on the principle of history repeats, which builds up the fundamentals of technical analysis. The shareholders look through the charts, graphs and volume to find out the reparation of the stock price in the market. Once it is done, the shareholders pick the stocks that would benefit them. They sell the stocks which are expected to devalue in future.

The concept of analysis of stocks is also based on the close relationship between stock prices and trends. According to this, the stock prices keep a keen journey with the trends. The prices shift within the trends. For instance, if there is a certain shift in the stock price, that soft would imply the next one. So, after the first shift, if the second shift takes place, the stock price would see a similar deviation.

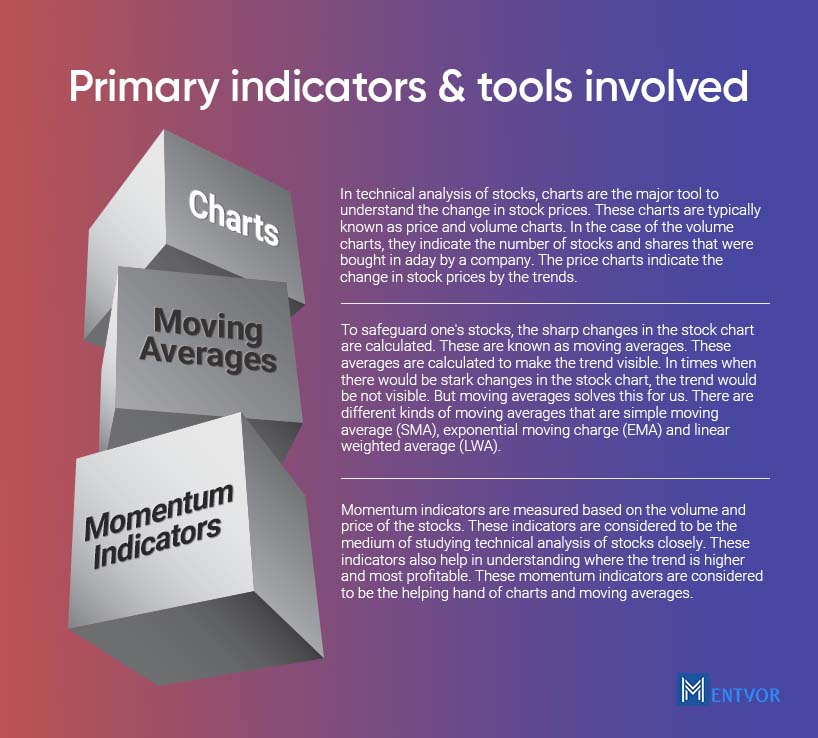

While doing a technical analysis of stocks, there are some primary indicators and tools involved. These are mentioned as below.

Charts

In technical analysis of stocks, charts are the major tool to understand the change in stock prices. These charts are typically known as price and volume charts. In the case of the volume charts, they indicate the number of stocks and shares that were bought in a day by a company. The price charts indicate the change in stock prices by the trends.

Moving Averages

To safeguard one’s stocks, the sharp changes in the stock chart are calculated. These are known as moving averages. These averages are calculated to make the trend visible. In times when there would be stark changes in the stock chart, the trend would be not visible. But moving averages solves this for us. There are different kinds of moving averages that are simple moving average (SMA), exponential moving charge (EMA) and linear weighted average (LWA).

Momentum Indicators

Momentum indicators are measured based on the volume and price of the stocks. These indicators are considered to be the medium of studying technical analysis of stocks closely. These indicators also help in understanding where the trend is higher and most profitable. These momentum indicators are considered to be the helping hand of charts and moving averages.

These are the major indicators and assistance used when doing technical analysis of stocks.

In a nutshell, technical analysis of stocks refers to finding the best step forward in buying or selling the stocks. Investing parting mostly conducts the analysis of stocks on three factors. These are- revenue, value and industrial trends.

For technical analysis of stocks regarding beginners, a lot must be known as a priority. This field involves an active and technical understanding. This spans the various factors, principles and assumptions involved in the analysis of stocks.

Let us know how to do technical analysis of stocks for beginners.

Read about Crytocurrency in Metaverse: Investing in the Metaverse: Different Cryptocurrencies in Metaverse and Technology Behind

Takeaway

For beginners, technical analysis of stocks refers to studying charts and graphs for selecting stocks. It includes the studying of the charts and graphs that show the latest trends for stocks pickup. The three main indicators of stocks are:

- Charts

- Moving Averages

- Momentum Indicators

How to do Technical Analysis Of Stocks For Beginners

For the freshers in the field of technical analysis of stocks, the first time execution will be overwhelming. However, preparing oneself beforehand could make the first day easier for technical analysis. Below are some noteworthy points on how to do technical analysis for beginners.

Be Familiarized With Market Psychology

In technical analysis of stocks, the stock market is the major area. It is the crust of finding the potential of buying or selling one’s stocks. Market psychology is said to be the understanding of behaviors of marketers. That is, the fresher in analysis must be efficient in finding out why a particular behavior has occurred in the market. This is concerning the shift in trend and change in stock prices. Again, knowing market psychology helps in interpreting the market behavior in aggregate. Further, it helps the fresher to expect the next shaft or change in the stock market.

Know And Select Right Type/Approach

There are two types of technical analysis for analyzing stocks. These are top-down and bottom-up. These types are known as two different approaches to technical analysis. The top-down approach is suitable if the technical analysis of stocks is for a short period. The bottom-up approach is suitable for the technical analysis of stocks for a long period. Again, the fresher must know how long the stock analysis should continue. If the value of the stocks seems to depreciate then selling it would be ideal. Based on these two approaches, the fresher can determine the appropriate period for technical analysis of stocks.

Curate Or Pick The Apt Strategy

Every technical analysis of stocks moves in fluency with the right strategy. It is the core of the structure and movement of technical analysis. For instance, you as a beginner have decided to study two moving averages of stocks. This becomes your strategy and you execute your stocks as per the reading through these averages. While framing a strategy, you also need to keep in check the shift in stock prices. With this comes the trends too. If the market trends escalate, there will be a rise in the stock price too. Based on these, the fresher would get the sell signal or buy signal for the stocks.

Know Your Securities

Stocks are classified too. They can be liquid, volatile, illiquid and stable stocks. Identifying the stocks type is important to know whether it could be traded or not. A fresher must have the knowledge in knowing which kind of stocks would be capable of selling or buying. Also, the right choice to make will be another criterion for the classified stocks. Hence, knowing these parameters is essential for finding the best provision for the stocks.

These are some of the knowledge factors for executing technical analysis of stocks. A beginner in the technical analysis of stocks must know these points to execute them well. These essential points make sure that the basics for the analysis of stocks are applied.

Read about Important of Artificial Intelligence: What Is The Importance Of Artificial Intelligence?

Takeaway

For beginners in technical analysis of stocks, the following steps must be followed. These are:

- Be Familiarized With Market Psychology

- Know And Select Right Type/Approach

- Curate Or Pick The Apt Strategy

- Know Your Securities

Parting Note

Technical analysis has reached different fields and sectors. It has penetrated the stock markets as well. Today, stocks are a very essential part of a company’s securities and stocks. Stocks are considered to be very important assets for any kind of corporation. They demonstrate the amount of partnership and ownership in the stock issuing corporation. This has given rise to another advancement, which is a technical analysis of stocks. Technical analysis of stocks is done to understand where the stocks investment would bring in optimum profits.

Understanding what stocks are is necessary to know what technical analysis of stocks is. In the simplest sense, stocks refer to the security which is indicative of the individual or venture’s share. This means that stocks are the fraction of security that an individual or the company holds and is the owner of it.

Technical analysis of stocks refers to the studying of charts and graphs for selecting stocks. It includes the studying of the charts and graphs that show the latest trends for stocks pickup. Accordingly, with the potential through charts and trends for stocks prices, further investments are done. There are three main indicators of technical analysis of stocks. These are:

- Charts

- Moving Averages

- Momentum Indicators

For a beginner, to know how to do technical analysis of stocks, the following points must be known. These are:

- Be Familiarized With Market Psychology

- Know And Select Right Type/Approach

- Curate Or Pick The Apt Strategy

- Know Your Securities

Technical analysis of stocks is a very handy concept to expect the upcoming and invest in the best!

Commonly Asked Questions

- How do beginners do technical analysis of stocks?

Technical analysis of stocks can be done by the beginners as:

- Be Familiarized With Market Psychology

- Know And Select Right Type/Approach

- Curate Or Pick The Apt Strategy

- Know Your Securities

- What are the best indicators of stocks?

The best indicators of stocks are:

- Charts

- Moving Averages

- Momentum Indicators

- What are the 3 types of analysis in trade?

In the trading world, various aspects must be analyzed for opening doors to new investments and achievements. For this, the trading world involves 3 types of analysis. These are:

- Fundamental Analysis

- Sentimental Analysis

- Technical Analysis

References

[1] Yamamoto, R. (2012). Intraday technical analysis of individual stocks on the Tokyo Stock Exchange. Journal of Banking & Finance, 36(11), 3033-3047.

[2] Achelis, S. B. (2001). Technical Analysis from A to Z.

[3] Hayes, A. (2021, September 13). Market psychology. Investopedia. Retrieved March 8, 2022, from https://www.investopedia.com/terms/m/marketpsychology.asp

[4] Seth, S. (2022, February 21). Technical analysis strategies for beginners. Investopedia. Retrieved March 8, 2022, from https://www.investopedia.com/articles/active-trading/102914/technical-analysis-strategies-beginners.asp

WhatsApp

WhatsApp